Forex Trading at Pocket Option: A Comprehensive Guide

Forex Trading at Pocket Option is an exciting journey that offers vibrant opportunities for traders. If you are looking to delve into the world of currency trading, Forex Trading at Pocket Option negociação forex na Pocket Option will be your ultimate guide. Understanding the dynamics of Forex trading, or foreign exchange trading, is essential for both new and experienced traders. This article will cover essential aspects of Forex trading, how to get started on Pocket Option, various strategies, and tips for maximizing your trading success.

Understanding Forex Trading

Forex trading involves the exchange of one currency for another, typically conducted over the counter (OTC) through a network of banks, brokers, and financial institutions. The Forex market operates 24 hours a day, allowing traders to engage in transactions across different time zones. The primary objective of Forex trading is to profit from fluctuations in currency exchange rates.

The Basics of Currency Pairs

In Forex trading, currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is known as the base currency, while the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding currency pairs is crucial for successful trading, as trading strategies often revolve around predicting how these pairs will change in value.

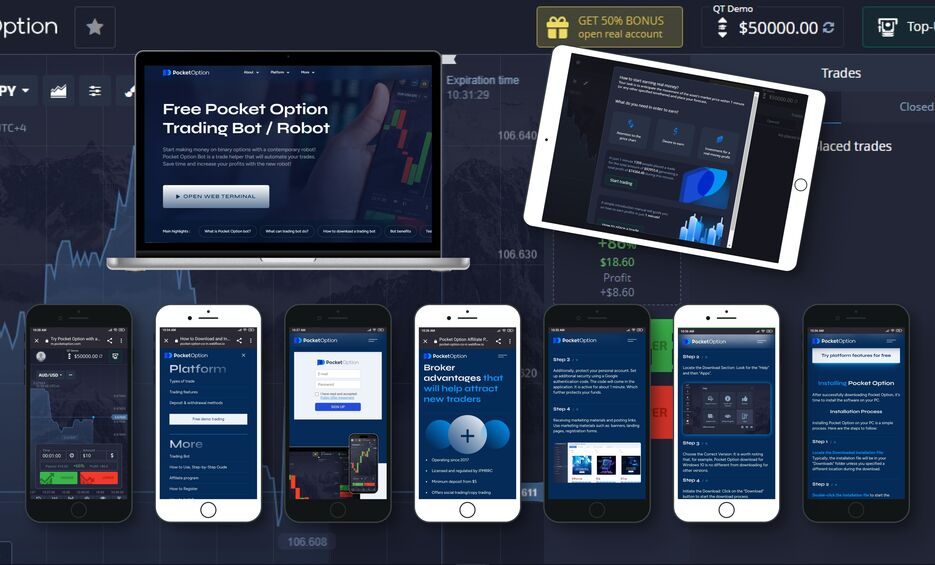

Getting Started with Pocket Option

Pocket Option is a popular trading platform that allows users to trade various financial instruments, including Forex, cryptocurrencies, stocks, and commodities. To get started with Forex trading at Pocket Option, follow these steps:

Create an Account

Sign up for an account on the Pocket Option website. The registration process is straightforward and typically requires basic personal information. You may choose a demo account to practice trading without risking real money before moving to a live account.

Fund Your Account

Once your account is established, you need to deposit funds to start trading. Pocket Option offers multiple payment methods for easy funds transfer, including credit/debit cards, e-wallets, and cryptocurrency options. Make sure to review the deposit and withdrawal policies to understand any fees that may apply.

Explore the Trading Platform

Familiarize yourself with the Pocket Option trading interface. The platform offers a user-friendly experience with various tools and features, including charts, technical indicators, and economic calendars for market analysis. Take advantage of the demo account to practice trading strategies without financial risk.

Developing a Trading Strategy

Having a well-defined trading strategy is crucial for success in Forex trading. Here are some common strategies you may consider:

Day Trading

Day trading involves opening and closing positions within the same trading day. Traders benefit from small price movements and aim to make quick profits. This strategy requires a solid understanding of market trends and a commitment to monitoring the market throughout the day.

Swing Trading

Swing trading involves holding positions for several days or weeks to capitalize on expected price movements. Traders use technical analysis and market trends to identify opportunities. This strategy is ideal for those who may not have the time to monitor the markets continuously.

Scalping

Scalping is a high-frequency trading strategy that focuses on making numerous small trades to accumulate profits. Scalpers typically trade within a short time frame, often executing multiple trades in a matter of minutes. This strategy requires quick decision-making and precise timing.

Risk Management in Forex Trading

Effective risk management is fundamental to long-term success in Forex trading. Here are some key practices to implement:

Use Stop-Loss Orders

Stop-loss orders are essential tools that allow you to limit potential losses. By setting a predetermined exit point for a trade, you can automatically close positions that move against you, minimizing your risk.

Position Sizing

Determining the appropriate position size for each trade is critical for managing risk. Traders should consider their account size, risk tolerance, and stop-loss levels when deciding how much to invest in a trade.

Diversification

Diversifying your trading portfolio is another effective way to manage risk. By spreading your investments across different currency pairs and financial instruments, you can reduce the impact of adverse price movements on your overall portfolio.

Staying Informed: Market Analysis

Staying informed about market trends and news is vital for successful Forex trading. Traders often utilize two main types of market analysis:

Technical Analysis

Technical analysis involves studying historical price data and using various tools, such as charts and indicators, to forecast future price movements. Traders rely on patterns, trends, and market signals to make informed trading decisions.

Fundamental Analysis

Fundamental analysis focuses on economic indicators, geopolitical events, and market news that can impact currency values. By understanding the factors that influence the Forex market, traders can make better-informed predictions and improve their trading strategies.

Conclusion

Forex trading at Pocket Option presents a wealth of opportunities for traders looking to engage in the dynamic currency market. By understanding the fundamentals of Forex trading, developing effective strategies, and employing sound risk management practices, you can set yourself on the path to success. Remember to stay informed, keep practicing, and continuously refine your trading approach for the best results.