Forex swing trading is a popular approach among traders looking for balance between long-term investing and short-term trading. This method allows traders to capture price movements over a few days to weeks, making it an appealing strategy for many. For those looking to engage in Forex trading, exploring forex swing trading strategies Pakistani Trading Platforms can provide ample opportunities and resources.

Understanding Forex Swing Trading

Forex swing trading involves holding positions for several days, aiming to profit from price fluctuations. Unlike day trading, where positions are closed within the same trading day, swing traders capitalize on longer-term trends or reversals. This strategy is less stressful than day trading as it requires less constant monitoring of the market while still providing a potential for significant profits.

Key Characteristics of Swing Trading

There are several defining features that set swing trading apart from other forms of trading:

- Time Frame: Swing trades are typically held for more than one day but less than several weeks.

- Technical Analysis: Swing traders often rely on charts and technical indicators to make trading decisions.

- Trend-Focused: This strategy focuses on set trends, looking for opportunities to enter when a currency pair shows potential for upward or downward movement.

- Risk Management: Effective risk management is crucial in swing trading due to the inherent volatility in the Forex market.

Popular Forex Swing Trading Strategies

1. Trend Following

The trend-following strategy is based on the idea that prices tend to move in the same direction for an extended period. Swing traders can identify the trend direction using moving averages, trend lines, or other technical tools. The main goal is to enter the market during the trend’s main movement and exit when signs of reversal appear.

2. Retracement Trading

This strategy focuses on identifying retracements in a trending market. Swing traders look for short-term reversals within the larger trend, allowing them to enter a trade at a better price. Common tools used for this strategy include Fibonacci retracements, support and resistance levels, and oscillators like the Relative Strength Index (RSI) to gauge potential reversals.

3. Breakout Trading

Breakout trading involves entering a position when the price breaks through a defined level of support or resistance. This approach relies on the idea that once a price break occurs, the momentum will likely push the price further in the direction of the breakout. Swing traders often use this strategy in combination with volume analysis to confirm breakouts.

4. News Trading

Economic news releases can significantly impact currency prices. Swing traders may choose to enter or exit positions based on upcoming news events, aiming to profit from volatility. It is crucial to stay up-to-date with economic calendars to identify high-impact news that might affect currencies.

Tools and Resources for Swing Traders

Success in swing trading requires access to the right tools and resources. Here are a few essential resources every swing trader should consider:

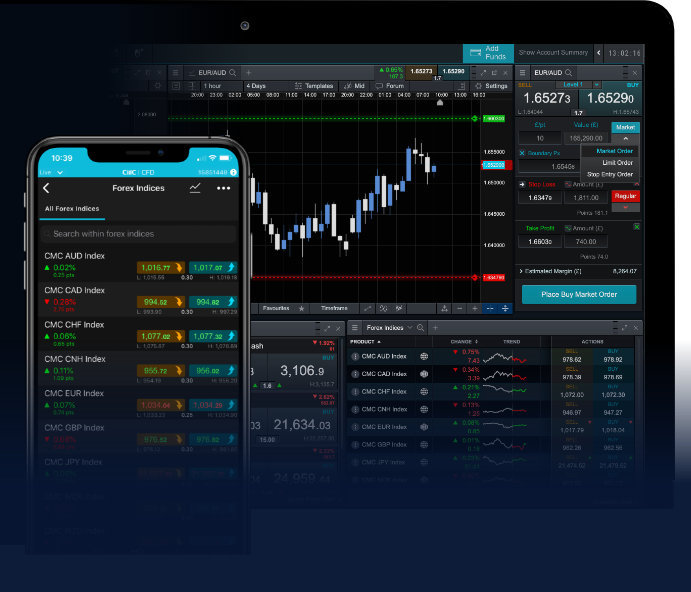

1. Trading Platforms

Choosing the right trading platform is vital. Look for platforms that offer advanced charting tools, technical indicators, and news feeds. Many brokers also provide demo accounts, which are beneficial for practicing strategies without risking real money.

2. Charting Software

Charting software helps traders analyze price movements using different charts, indicators, and time frames. Programs that allow for custom indicators can also assist in developing and testing trading strategies.

3. Economic Calendars

An economic calendar provides important data release dates related to economic indicators. It’s key for swing traders to track events that can affect the Forex market.

Risk Management in Swing Trading

Effective risk management is essential in any trading strategy, including swing trading. Here are some fundamental risk management tips:

- Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses, ensuring they are placed at a level where you can tolerate losses.

- Position Sizing: Determine the proper position size based on your account balance and risk tolerance. A commonly used approach is to risk only a small percentage of your account on a single trade.

- Keep a Trading Journal: Maintaining a trading journal helps in analyzing past trades, understanding mistakes, and improving future performance.

Conclusion

Forex swing trading offers a unique opportunity for traders to capture price fluctuations with a balanced approach regarding risk and reward. By applying various strategies, utilizing suitable tools, and adhering to effective risk management principles, traders can find success in the dynamic Forex market. Whether you are a beginner or an experienced trader, these strategies can enhance your trading effectiveness and contribute to long-term profitability.